OUR STRATEGY

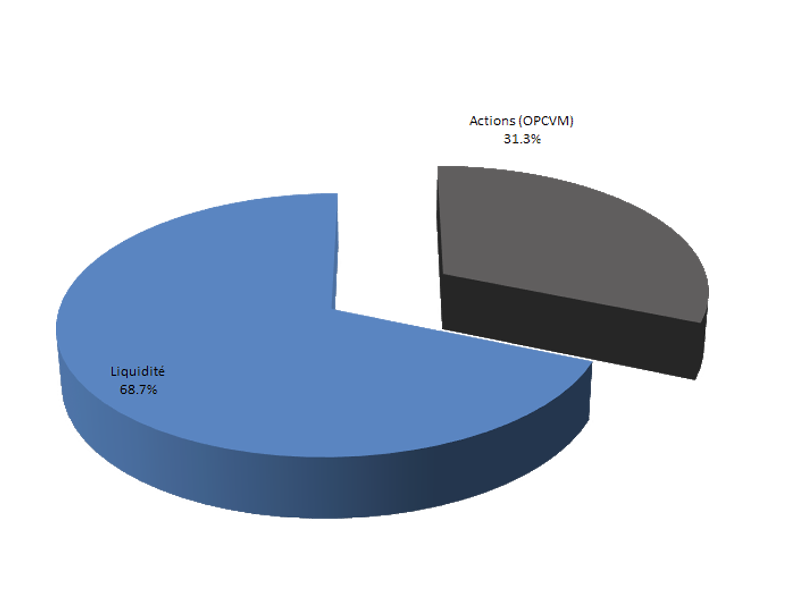

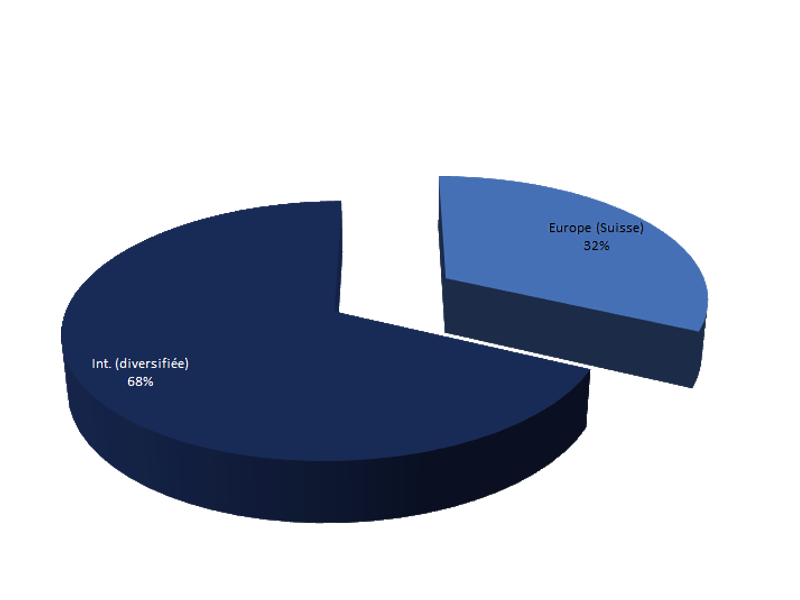

Considering the very low level of global interest rates, the strategy developed consists in minimizing exposure to rate increase risks. Overall risk is therefore limited by building portfolios exposed to equity and currency risk at very short-term rates. For example, balanced profiles include between 40% and 80% short-term UCITS or money market funds and the balance in UCITS or equity securities.

DIFFERENT STRATEGIES AVAILABLE:

Class A : situation at 08/31/2022

OUR STRATEGY

Considering the very low level of global interest rates, the strategy developed consists in minimizing exposure to rate increase risks. Overall risk is therefore limited by building portfolios exposed to equity and currency risk at very short-term rates. For example, balanced profiles include between 40% and 80% short-term UCITS or money market funds and the balance in UCITS or equity securities.

DIFFERENT STRATEGIES AVAILABLE:

Class A : situation at 08/31/2022